Through official documents originating from various companies, email exchanges, financial statements and portfolio management reports, inkyfada unveils how the multi-millionaire was able to invest and accumulate millions of dollars, with the utmost discretion. According to the leaked documents, he was a legal resident of Tunisia, but used intermediaries and more or less complex arrangements to take advantage of the discretion offered by these tax havens.

In this way, he would be able to avoid the taxation due on transactions to these "privileged tax regime"-countries, or to violate foreign exchange regulations, which require a declaration of assets abroad. Rached Horchani and his partners preferred to remain silent in regards to this, despite multiple attempts by inkyfada. But how did the businessman manage to hide millions of dollars under the radar?

The Horchani galaxy

To understand the scope of the Horchani group in the Tunisian business world, you need only take a look at their website*. Rached Horchani began his career in 1983, with what was to become a household staple in Tunisia, the Manar tuna can. Since then, the group has positioned itself in the agri-food sector, specialising in production, processing and exportation of dates, seafood and olive oil. But Rached Horchani did not stop there.

Since 2013, the businessman has been conquering the financial sector and now holds significant shares in the largest Tunisian banks and financial institutions. Over the years, he has become the majority shareholder of Taysir Microfinance, acquired nearly 7% of capital at BIAT, and increased his shares in Amen Bank, STAR Insurance and Tunisie Leasing.

In 2019, Horchani Finances, the group's holding company, moved up a gear by increasing its shares in the capital of the Habitat Bank (BH Bank) to 21%. As a result, on the Tunis stock exchange, the amount of transferable securities held by the Horchani group would exceed 100 million dollars, making Rached Horchani certainly one of the richest men in the country.

However, among the dozens of companies listed on the various mediums of the Horchani Group, or found in the commercial registers, one company is nowhere to be found: Carlisle Investments Inc. This company is worth millions of dollars, but it is all very secretive.

The existence of this company, as well as the identity of its 'final beneficiary', was revealed in the midst of millions of leaked documents in the Pandora Papers, an investigation led by the International Consortium of Investigative Journalists (ICIJ) and its partners, including inkyfada.

Carlisle Investments Inc, a company tucked away in the Virgin Islands for almost 30 years

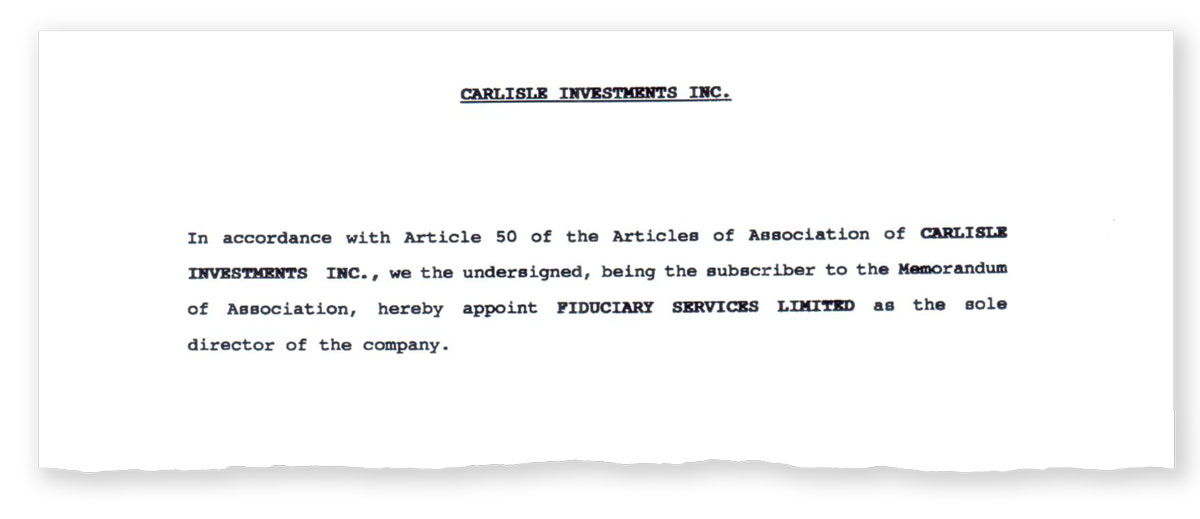

Carlisle Investments Inc. was founded in 1992 with unknown origins. It was incorporated in the Caribbean, more specifically in Tortola, the capital of the British Virgin Islands, and the initial directors have no age, nor gender, and are not even made of flesh or bone.

These directors are called "Fiduciary Services Limited", "Fairfield Nominees Ltd" or "Standard Nominees Limited", and in order to sign on behalf of these companies, real people are hired to act as figureheads, and are appointed as directors or shareholders - sometimes both. Paid to present themselves as the owners or managers of a company, these people have few real responsibilities, and usually no relationship to the real beneficiaries.

Establishment of Carlisle Investments Inc. in 1992

In this game of musical chairs, a new conductor emerged: Marco Maximilian Elser. In 1995, "Standard Nominees Limited" (the then sole director of the company), gave him full powers of attorney. With this single "power of attorney" document, Mr. Elser became the legal guardian of Carlisle Investments Inc. He could thereby manage its assets, open bank accounts, order transactions, and buy or sell shares in companies for an indefinite period.

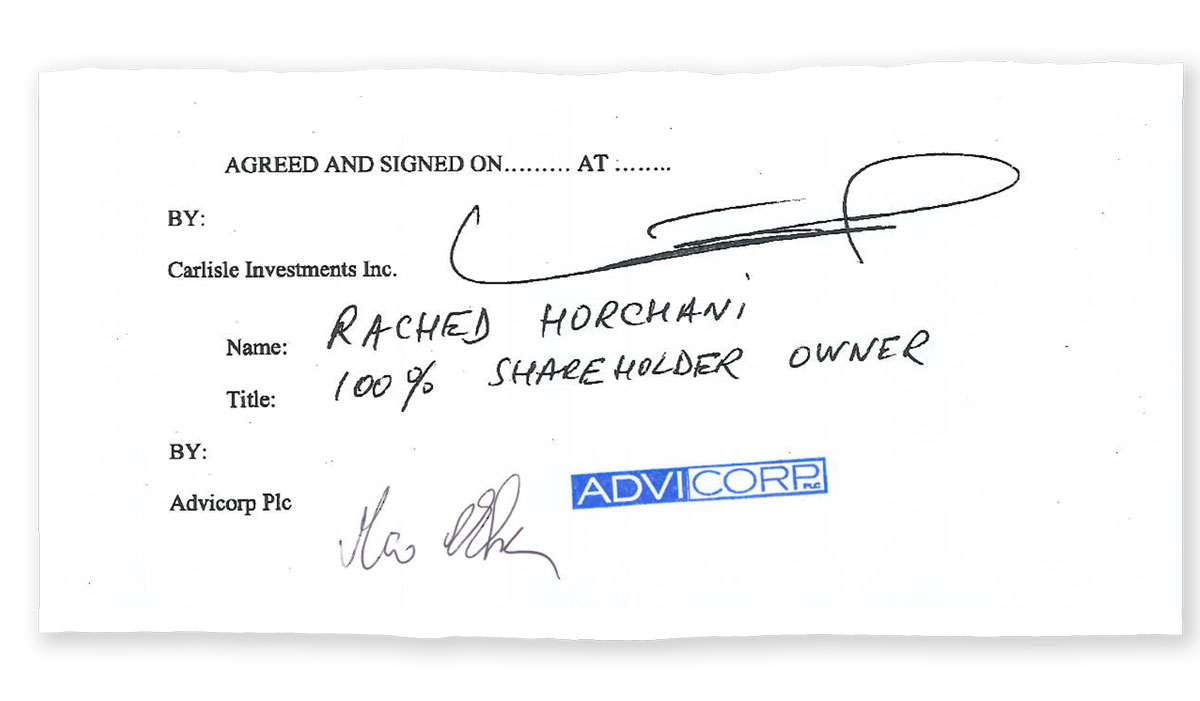

Rached Horchani's name is only first appears in an agreement from 2007, according to documents kept by the offshore service firm Trident Trust Company, which creates shell companies in order to hide the identity and activities of its clients and minimise taxes. This is a "strictly private and confidential" contract between Carlisle Investments Inc. and AdviCorp PLC (Marco M. Elser's company). The Tunisian businessman signs on behalf of Carlisle and specifies his title: "100% shareholder owner".

Worldwide investments with millions of dollars, euros and other currencies

This map gives an overview of the various players but is not exhaustive. It shows only a tiny fraction of the holdings in companies - those for which documents have been obtained through Trident Trust - and not the many holdings listed in the account statements of financial institutions.

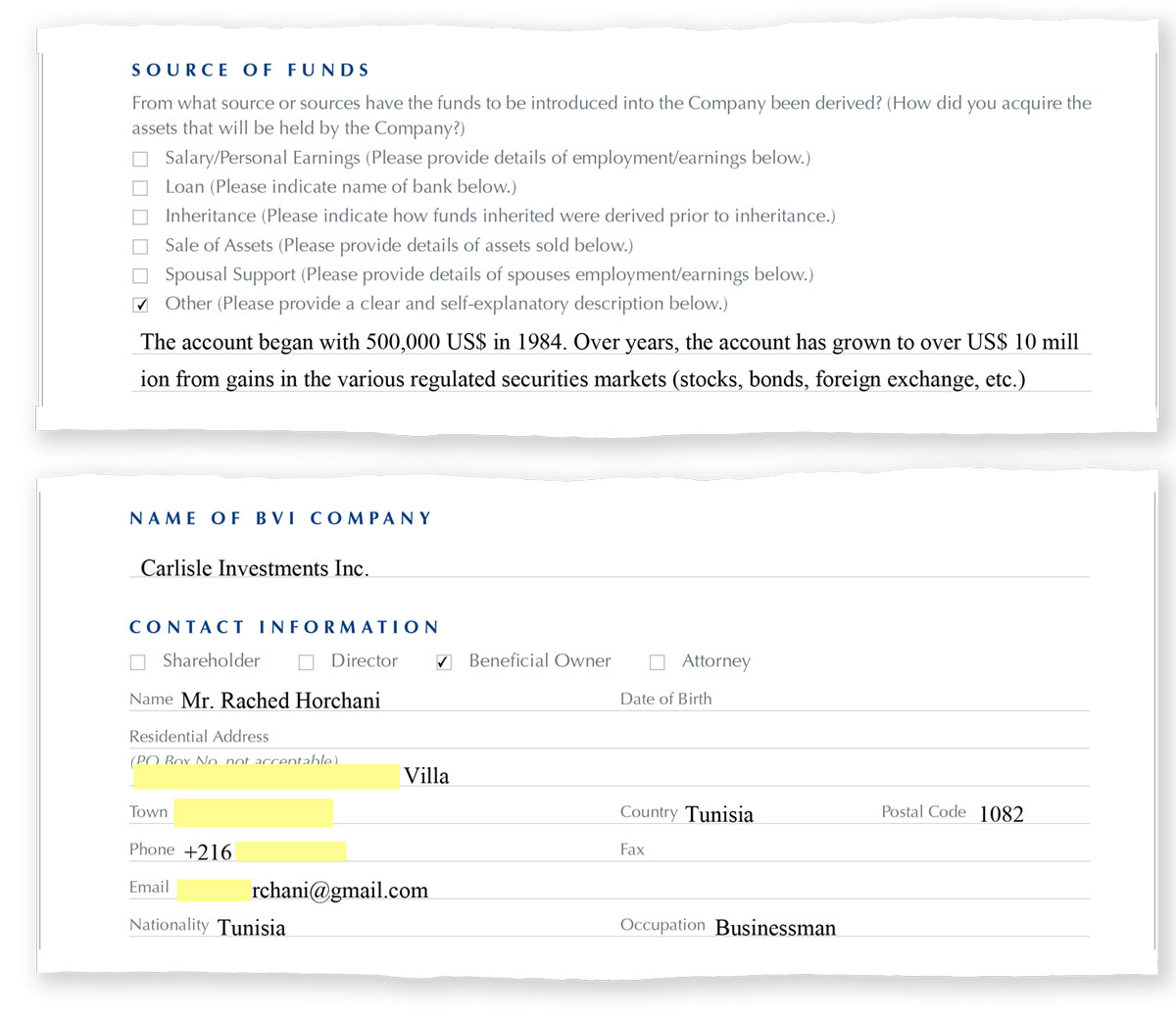

"The account started with 500,000 dollars in 1984. Over the years, the account has increased to more than 10 million dollars through gains in the various regulated markets (stocks, bonds, foreign exchange, etc.)."

The declared origin of the funds of Rached Horchani's company is described in an administrative form sent to Trident Trust in 2011. In the same document, Marco Elser states that Carlisle was set up to hold bank accounts, investment portfolios and shares in other companies.

At the time, regulations were becoming stricter, including in tax havens that were known to be secretive, forcing offshore management companies to record information on the "final beneficiaries". In this context, Tunisie Telecom invoices were also communicated to Trident Trust, proving Rached Horchani was resident in Tunisia.

Thanks to this arrangement, the businessman was able to hide millions of dollars and to bypass strict Tunisian regulations in terms of foreign exchange, transactions and assets abroad, knowing that none of Carlisle's transactions are linked to any real economic activity declared by Rached Horchani.

The documents obtained by inkyfada and the research carried out did not reveal how Horchani was able to transfer his original funds to the accounts of his offshore company, knowing that according to the legislation in force, all outgoing currency has to go through the BCT. Despite inkyfada's attempts to obtain more information from the person concerned, no answer was obtained.

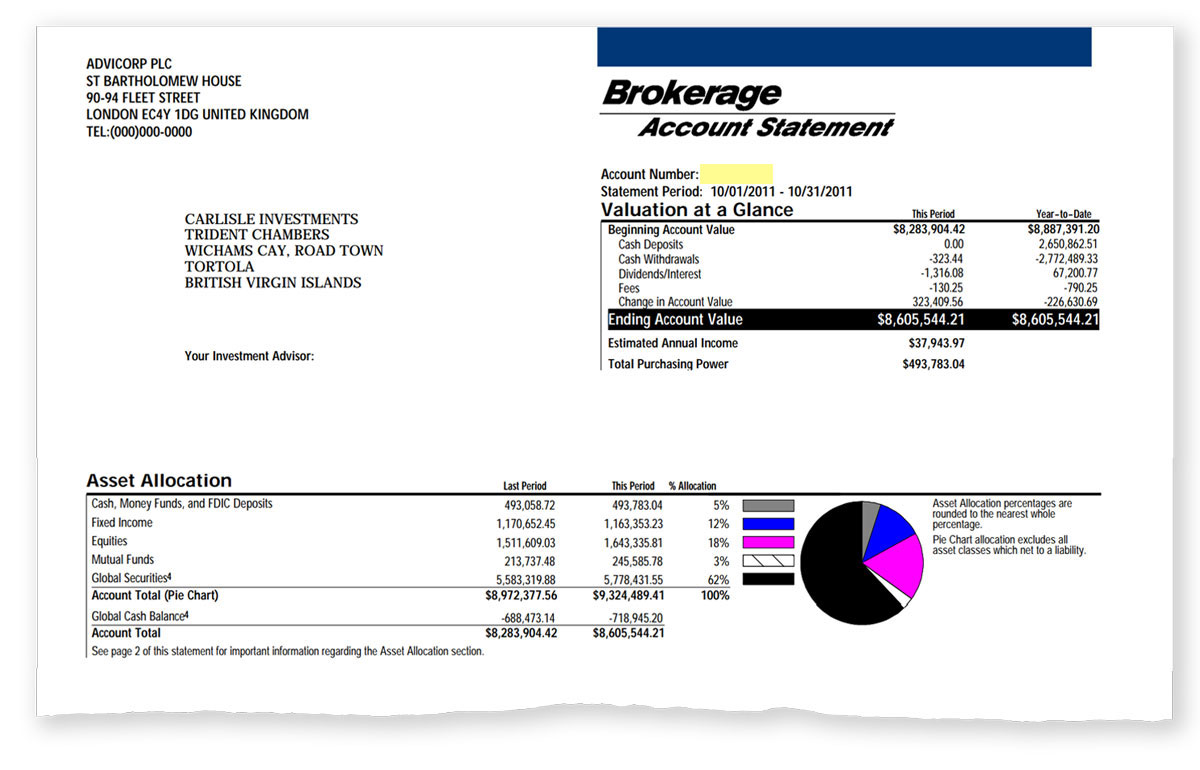

To make sure his money increases, Rached Horchani uses banks, portfolio management companies and online brokers. An account statement at Pershing LLC, a subsidiary of Bank of New York Mellon, shows a total value of more than 8.5 million dollars in October 2011.

Pershing LLC | Account statement - October 2011

The amount shown consists mainly of a portfolio of transferable securities and other investments (shares, bonds, pension funds, foreign exchange, equity stakes in other companies). These investments are listed according to the different currencies involved: US dollar, euro, yen, pound sterling, Swiss franc, Thai baht and Hong Kong dollar.

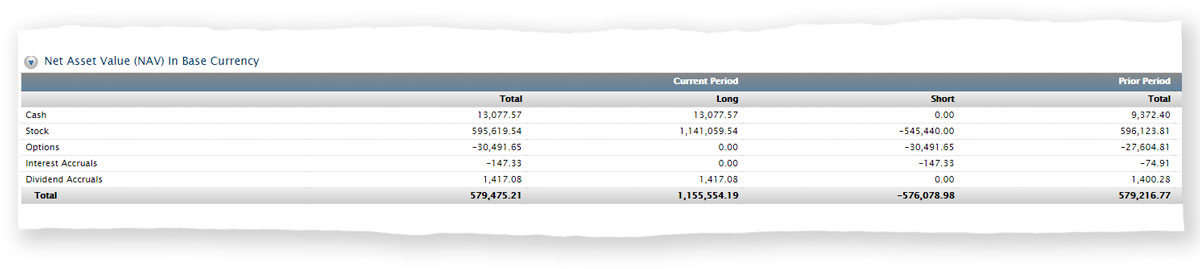

According to other obtained documents from Trident Trust, Rached Horchani's small company in the Caribbean Sea has other accounts. These include "Interactive Brokers", an online broker, which managed a portfolio estimated at several hundred thousand dollars in 2012, and an account at Goldman Sachs, the details of which are unknown.

Interactive Brokers | Extract from the account statement - 2012

Obscure transactions at companies linked to Marco M. Elser

Marco Maximilian Elser administers and manages the accounts and shareholdings of Carlisle Investments Inc. He is the face of Trident Trust, gives instructions to financial institutions (including paying management fees to his own company, AdviCorp and Lonsin Capital). Via Rached Horchani's company, he buys shares, grants loans or pays off the liabilities of companies in which he has direct or indirect interest.

Among the many shareholdings of Carlisle Investments Inc. in other companies, some of the choices made by Marco Elser (the company's director on behalf of Rached Horchani), are noteworthy. In particular, Elser was the director and/or shareholder of two financially troubled companies incorporated in Delaware (a US state also known as a tax haven): Trans-Lux Corp. and Protalex Inc.

Through Mr. Elser, Carlisle Investments Inc. granted two loans of 500,000 dollars each to Trans-Lux Corp. These loans and their 12% interest were to expire in 2017 and 2019, respectively. However, the company's latest statement indicates that the repayment was not made on time. This would not be a problem as Rached Horchani's company agreed to postpone the payments to a later date, and the document clearly states that "Marco Elser, former director of [Trans-Lux Corp.] has decision-making powers as a director of Carlisle".

In the same vein, Carlisle acquired a stake in Protalex Inc, another company incorporated in the same jurisdiction, by purchasing 2,500,000 shares for 500,000 dollars. A few months later, Protalex announced to its shareholders that it would cease operations and Marco Elser resigned. The company was eventually dissolved in 2021.

Already in 2007, after regaining his power of attorney over Rached Horchani's company, Marco Elser decided to acquire Upgrade Srl, a company based in Italy, for a value of 1.3 million euros, including its outstanding debts of 1.2 million euros. Even if the link between this company and the intermediary is not established, the choice of this investment may still seem surprising.

In the aforementioned contract between Rached Horchani and Marco Elser, the latter does indeed have full powers to manage accounts and invest in companies, including in the event of a conflict of interest. But was the Tunisian businessman aware of these transactions? Neither he nor Elser responded to inkyfada's questions on the matter.

A "tragicomical farce": transparency demands and residency issues

The tax haven business is not always a smooth ride. In an email from 2011, a Trident Trust employee tells her superior about her dismay with the 'gentleman' Marco Elser.

"The gentleman went berserk on the phone and SB had to intervene. [...] We are waiting for a reply from him telling us what details need to be in the new power of attorney so that we can issue it and revoke the old one. He has not responded to this, but returned this morning with a copy of another power of attorney/agreement from Mr Horchani issued in 2007 without our knowledge. This is a problem because we are both director and shareholder, but everything that Mr Horchani authorises, Mr Elser was already authorised to do in the mandate. My problem is that Mr Elser is trying to authorise a payment to the company he works for. Let me know what you think."

Over the years, the relationship between Marco Elser and the employees of Trident Trust became increasingly difficult as regulations changed and demands for transparency about "final beneficiaries" became more prevalent. For this Italian-born, hard-nosed American, these ever-pressing demands, whether to transfer money or to invest in other companies, became (in the course of often bizarre exchanges) "a tragicomical farce of epic proportions".

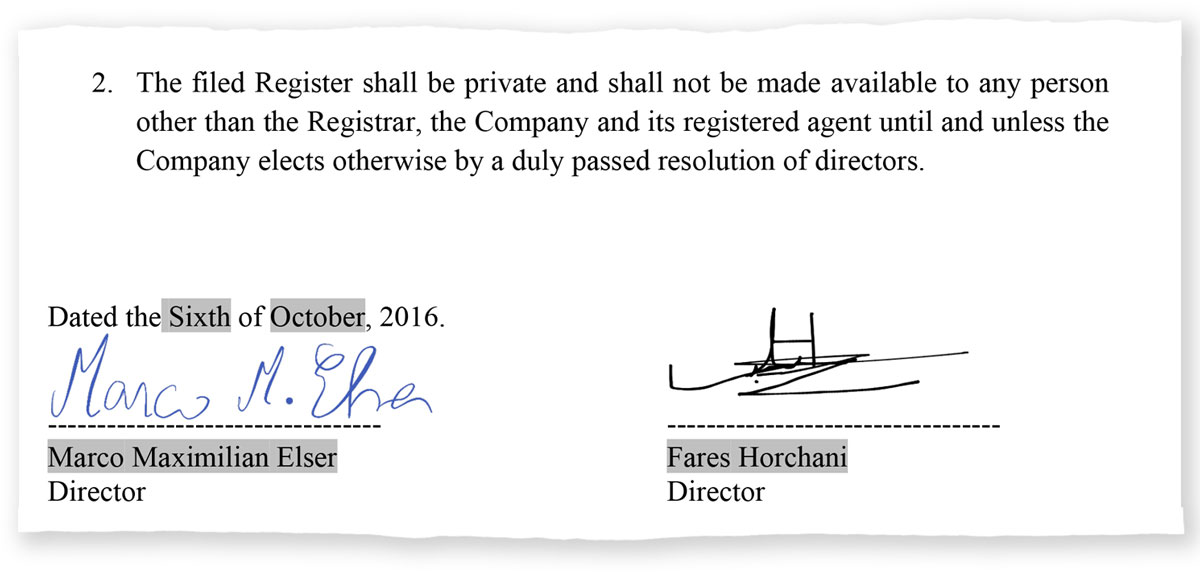

In October 2016, after years of constant back and forth, Marco Elser and Fares Horchani (Rached Horchani's son, who resides in the United States) were appointed directors of the company, with an unusual arrangement for directors of offshore companies: a confidentiality clause.

Fares Horchani and Marco M. Elser, directors of Carlisle.

But the partners were not finished yet, and Trident Trust came back one last time*. In 2017, the offshore services company contacted Marco Elser again to update its company data. A number of documents (tax returns, proof of residence, identity documents, etc.) were requested in order to comply with "current legislation [...] and the policy applied by Trident".

This was all it took to incur the wrath of Marco Elser who tried to communicate incomplete information about his client's tax returns. He claimed that Rached Horchani did not have a tax ID in Tunisia because he was now resident in Malta. However, this excuse did not convince the Trident Trust employee as no address in Malta was substantiated.

Finally, "satisfactory" documents concerning the Tunisian businessman were transferred, allow the company to be in good standing and to continue its activities. However, on the new official documents issued, there was no trace of Marco Elser or Fares Horchani as the directors of Carlisle. Only Rached Horchani's name appeared, still with his Tunisian address, and as the sole director since 2013...

Illegal transactions

According to the Tunisian foreign exchange regulations, "any Tunisian with habitual residence in Tunisia, any Tunisian legal entity as well as any foreign legal entity with establishments in Tunisia, is obliged to declare all its assets abroad to the Central Bank of Tunisia within six months".

In addition to the obligation to declare his assets abroad, Rached Horchani, as a resident in Tunisia, could not dispose of these assets, or "modify their content" without prior authorisation from the Central Bank (BCT).

Violations of foreign exchange regulations are punishable in Tunisia by up to five years' imprisonment and a fine, in addition to the confiscation of the assets considered as "corpus delicti".

Regarding income earned in countries "with a privileged tax regime" (i.e. more than 50% lower than the taxation applicable in Tunisia), these are taxed at 25% since 2019. The British Virgin Islands are on the list of countries or territories concerned.

On the subject of the obligation to declare and pay taxes on millions of dollars transiting through a company based in an ambiguous tax haven, and which still refuses to exchange information with other jurisdictions, Rached Horchani has chosen to remain silent.