This austere-looking neighborhood with its empty streets is home to the assets of many kleptocrats cited in the so-called "illegally acquired assets" files: the Mubarak clan, Al Assad, Obiang, but also Ben Ali.

Number 44 is a real estate complex valued at more than one million euros, owned by the former President's daughter Dorsaf Ben Ali and her husband, businessman Slim Chiboub, through a real estate investment company (Société Civile Immobilière or SCI).

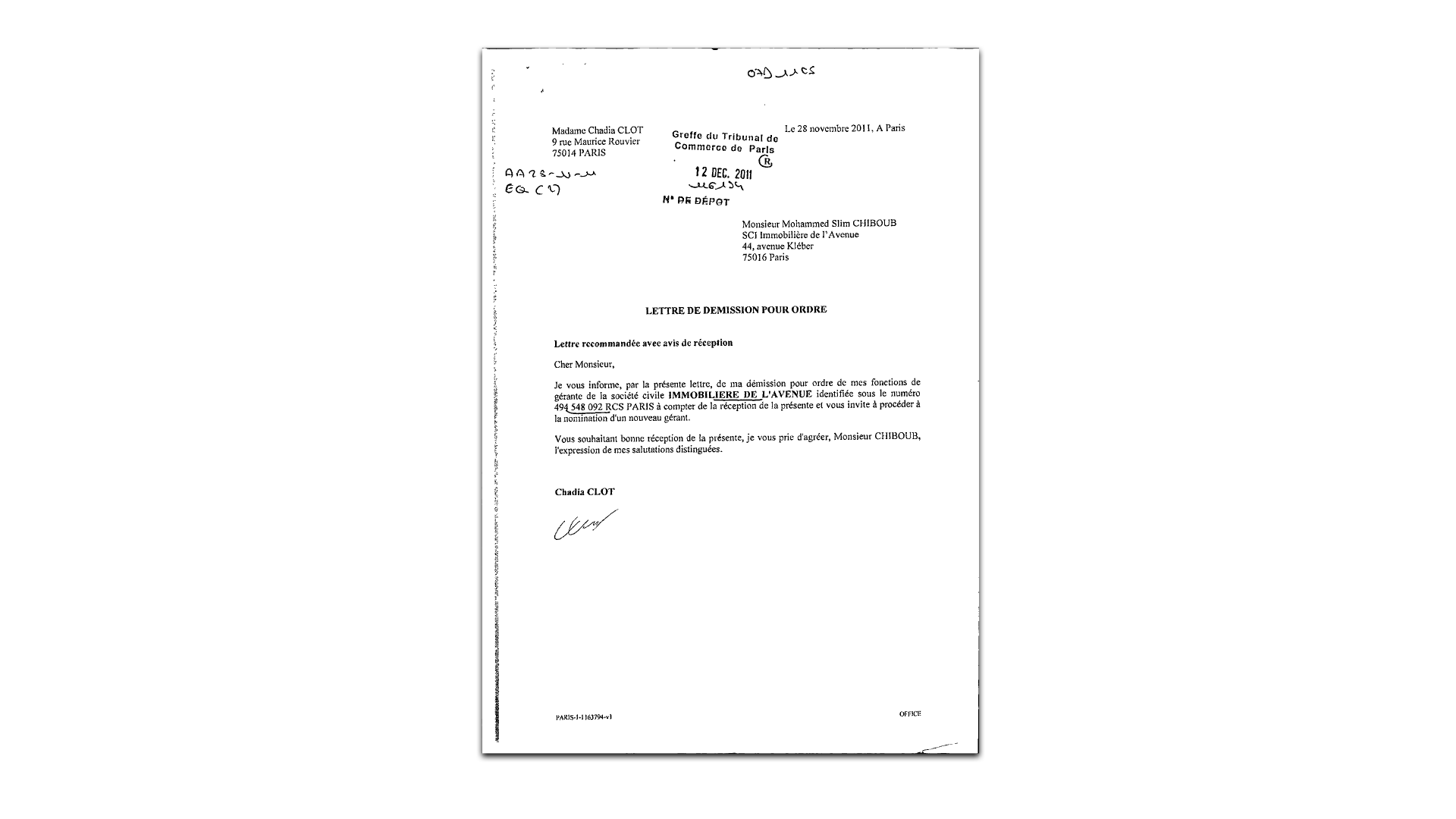

This company was supposed to be frozen since February 4, 2011, following the downfall of Zine El Abidine Ben Ali and his relatives. However, just a few months later, in November of the same year, Chadia Clot, the company manager, resigned from her position, which was in violation of the freezing measures underway at the time on all assets belonging to the Ben Ali clan.

Resignation letter of Chadia Clot

This was one of about thirty violations of the asset freezing measures imposed on the Mubarak and Ben Ali clans in the wake of the Egyptian and Tunisian revolutions in 2011.

While these freezes have been widely supported in view of the sanctions imposed on Russia for invading Ukraine, the French State has nevertheless encountered serious difficulties in implementing them in the past, which begs the question of the effectiveness of these measures.

Thirty violations in the span of ten years

A housing stock worth between 25 and 35 million euros at purchase price for the two clans, consisting of a dozen luxurious apartments mainly located in the 8th and 16th arrondissements of Paris, in addition to ten or so real estate investment companies and several million euros held in multiple bank accounts.

This is the known wealth of Ben Ali and Mubarak in France. During the 2010-2011 Arab revolutions, several experts around the world estimated that each clan's fortune amounted to about 175 million euros and 70 billion dollars respectively. While both regimes have collapsed under popular pressure that has been suppressed for decades by authoritarianism, poverty, State clientelism, and corruption, the unveiling of the wealth of their dignitaries is a cause for concern.

A private hotel owned by one of Ben Ali's daughters, Nesrine: more than 2.5 million euros. A real estate lot owned by her sister Dorsaf, in the 16th arrondissement: 1.2 million euros. A real estate complex shared between Heidi El Gammal, Mubarak's daughter-in-law, and her relatives: more than 4 million euros.

The list of possessions belonging to the kleptocratic dignitaries, which was widely disseminated in the international press, kept growing and eventually caught the interest of the judicial systems of the new regimes in Tunisia and Egypt, as well as that of France.

It was the complaint lodged by the associations Sherpa and Transparency International France that prompted the initiation of a French criminal investigation into the two clans for "corruption, misuse of corporate assets, concealment of misuse of corporate assets, money laundering and embezzlement of public funds".

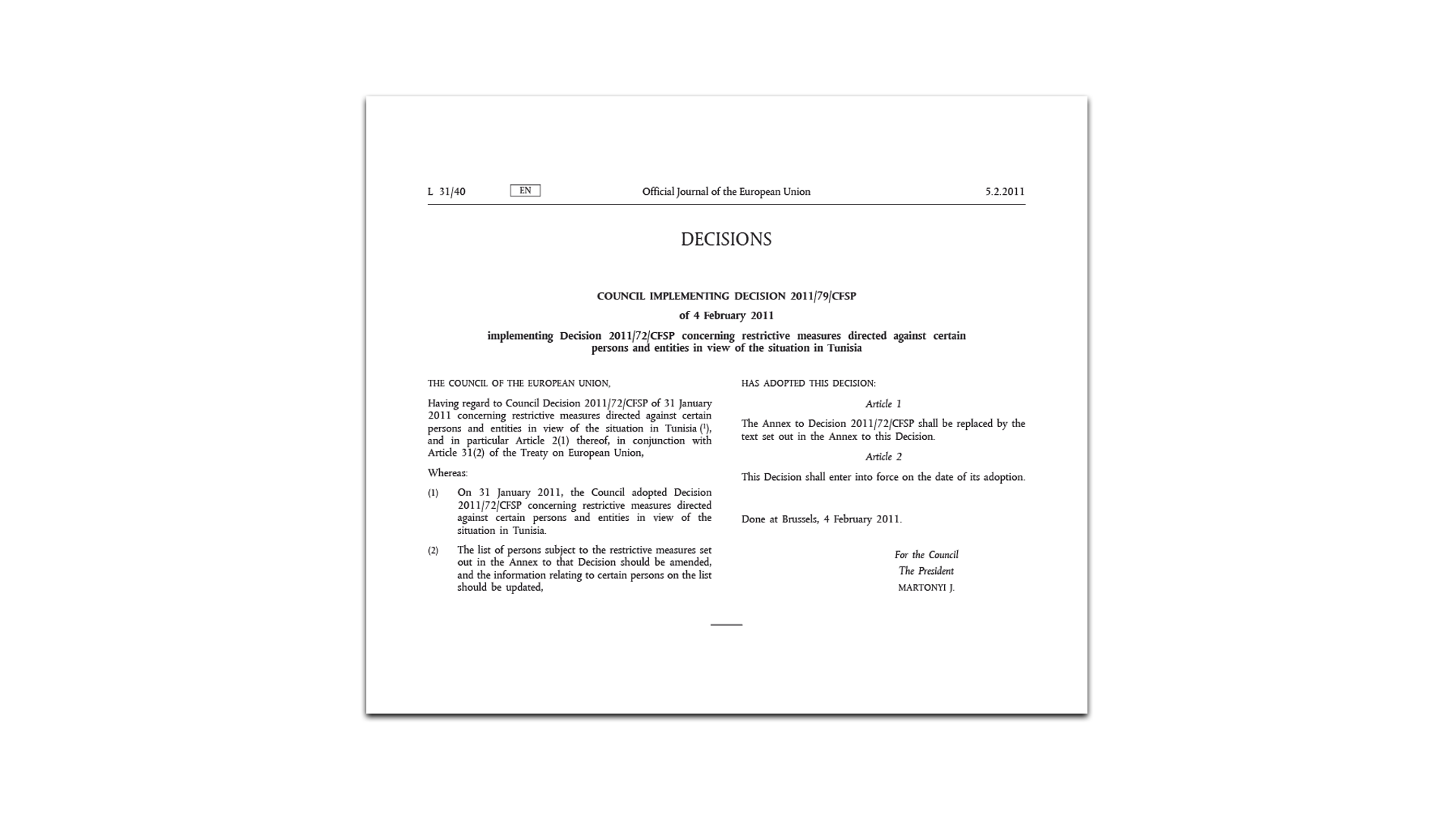

These procedures were further supported by an asset freeze order issued by the Council of Europe in 2011, across the entire European Union, including France.

The freeze involved more than forty Egyptian and Tunisian personalities and was intended to prevent any use, transaction or modification of their assets, whether bank accounts, companies, vehicles, or even real estate properties.

However, over the course of 11 years, these provisions seem to have been bypassed on nearly thirty occasions in France. These same offenses were not identified by the Bercy services and haven't led to any prosecution to date. When contacted, the latter referred our journalists to the customs authorities responsible for asset-related violations, but they did not provide any answers.

Musical chairs in property management

These violations reflect the effective asset management by the individuals listed in the freeze order and their relatives. Such was the case, for instance, with several transfers of shares in SCIs which were used to manage real estate owned by the two clans. Most of these transfers took place in the months following the said freezes.

These share transfers are sometimes a way for property sellers and other brokers to get out of problematic properties. In May 2011, Virginie Bennaceur, François Bennaceur's wife - a property trader and regular at Parisian parties who was behind the sale of a Parisian mansion to Nesrine Ben Ali - left the management of the SCI Nes owned by the former Tunisian President's daughter.

In November 2011, the businesswoman Chadia Clot, a close friend of the Qatari royal family, resigned from the co-management of the SCI owned by Dorsaf Ben Ali and her husband, Slim Chiboub. The Belgian authorities suspected that this property represented a "right of entry" paid by the Emir of Qatar to President Ben Ali's relatives, for the construction of a marina in Tunisia.

Such transfers sometimes directly benefit the relatives of former managers. That is how the former Egyptian Minister of Industry, Rachid Mohammed Rachid and his wife were able to transfer all the shares of the "SCI 51 Avenue Montaigne" to their daughters in February 2013.

The outcome of the operation: in the event of the seizure of the couple's properties, nearly 3.9 million euros worth of real estate (two Parisian lots and an apartment in Cannes) could slip through the net of the French justice system.

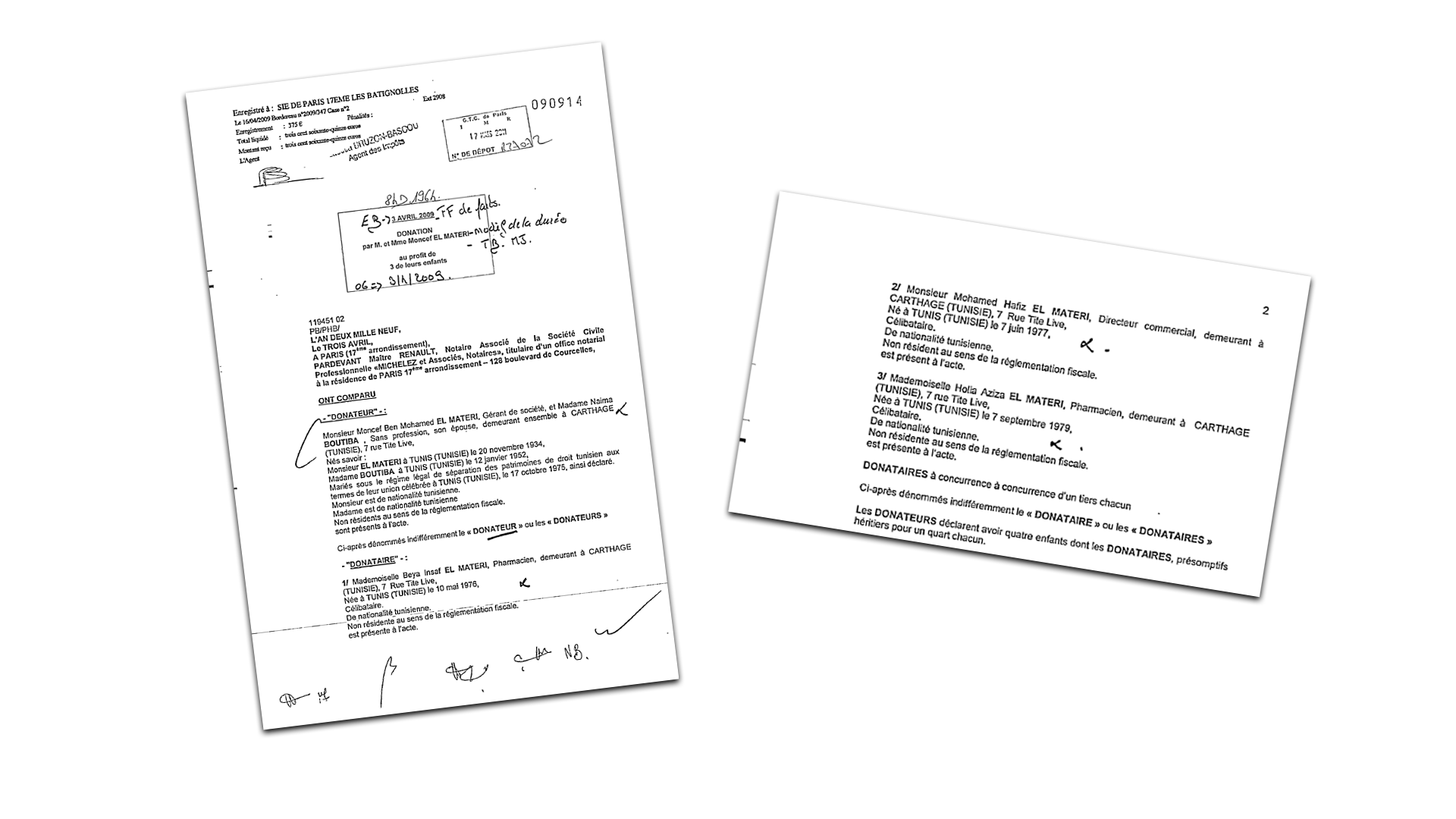

The businessman Sakher El Materi's parents also made similar share transfers in March 2011, a month after the European sanctions, for the SCI "Noucha". A real estate company registered in Nice, on the French Riviera.

Uninterrupted activities of a Mabrouk's company despite the freeze

In addition to these real estate gimmicks, there were other tricks, such as relocating a company's head office, renaming a company or mortgaging real estate, as well as managing certain companies that were supposed to be frozen.

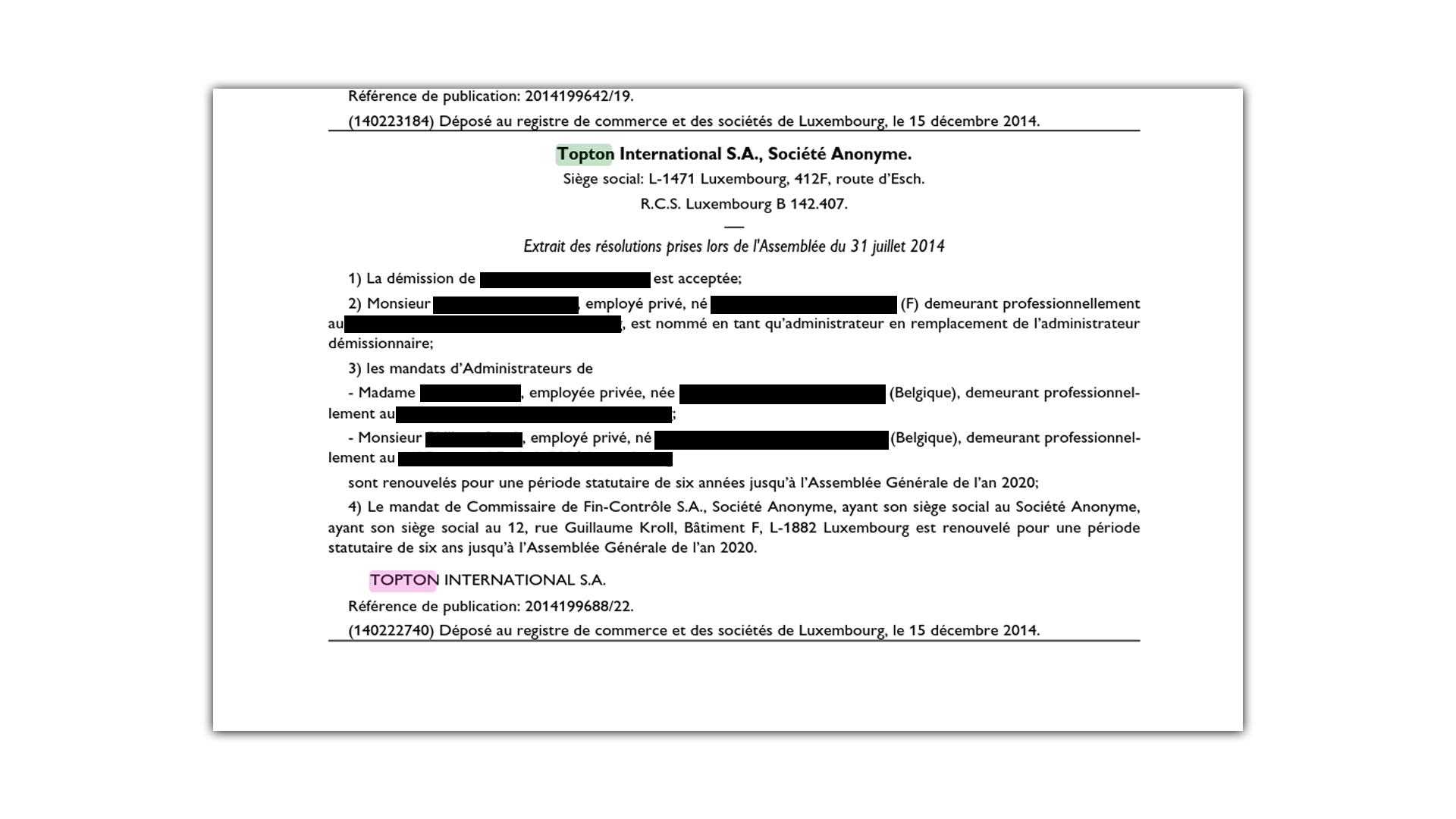

The European freeze had little to no effect, for example, on the Luxembourg company Topton International SA, owned by Marouene Mabrouk. Although the businessman was on the European freeze list from 2011 to 2019, he was still able to manage his company for several years after the freeze.

This was a blatant violation of the then-current asset freeze, as proven by several reports in the Luxembourg company register, which revealed multiple general meetings related to the management of this company from 2011 to 2015 as well as the resignation of an administrator.

Following the unfreezing of Mohamed Marouane Mabrouk's assets in Europe in 2019, he dissolved the Luxembourg company Topton International SA, thus allowing the assets to be transferred directly in his own name. The operation was perfectly legal in the absence of the French freeze, despite there being an open criminal investigation against Mabrouk. The property was never seized, as Le Monde OpenLux investigation has revealed.

Topton International SA was also listed as the manager of another real estate investment company which is its French branch: SCI ICARUS. The latter owns a property located in the 7th arrondissement of Paris and several violations have also been noted. This is why, when Marouane Mabrouk dissolved the Topton organization, he directly became the owner of the said real estate.

Tunisia-Egypt: Failure to Recover “Illegally Acquired Assets”

The Ministry of Economy and Finance, known as Bercy, reiterated that the freezing measures were separate from the legal proceedings still underway at the National Financial Prosecutor's Office (Parquet National Financier or "PNF") against the two clans.

It is, however, obvious that these measures are interrelated: if the freezing of a certain property is not respected, then nothing prevents the transfer of the property to a third party, in order to evade any possible criminal seizures.

"Although French regulations in this area have improved significantly in the past few years, there are still many loopholes," commented Sara Brimbeuf, Head of Illicit Financial Flows Advocacy at Transparency International France.

"For instance, companies registered abroad are not under the obligation to declare their beneficial owners in France. All it takes to lose track of the beneficial owner is for a company registered in a tax or legal haven to intervene in the financial scheme".

For its part, the PNF recalled that other seizures involving former Egyptian dignitaries had indeed taken place. But when asked why some of them were dropped, the judicial authority mentioned "a reconciliation agreement" that had been reached in Egypt:

"In order to be able to seize these assets again in French judicial investigation procedures, proof of the illicit origin of the funds, as well as their financing circuit, must be demonstrated, which often proves to be complex, and presupposes the active cooperation of the State of origin".

In its 2017 report entitled " Failed Recovery", the Swiss association Public Eye had already expressed its concern about these "mysterious agreements" of reconciliation, where the Egyptian state had become uncooperative with the Swiss justice system, preferring a behind-the-scenes arrangement with the defendants.

A 2018 testimony by the Tunisian NGO I-Watch revealed that the Tunisian State had also pressured the EU to unfreeze the assets of certain individuals.

The reality is that nearly twelve years after the Arab revolutions, the hope of restitution of illegally acquired assets Egyptian and Tunisian assets has never been so distant.

For its part, the EU has already turned the page on Egyptian assets, cancelling the freezes in April 2022 and considering that they "have fulfilled their purpose".

Could this unfreezing be the first of many? In France, as well as in the rest of Europe, 35 Tunisians who were close to former President Ben Ali still have their assets frozen - and an investigation is still underway in France against those who were closely involved with him.

As a civil party, Transparency International France has sent two letters to the investigating judge handling the criminal investigation of the Mubarak and Ben Ali cases, requesting several procedural acts in October 2022 in the hope of reopening the case.

France still needs to learn from the many failures regarding asset freezes, now that an asset freeze involving more than 1300 individuals connected to the Russian invasion of Ukraine is supposedly underway.