Over the past decade, going through these service providers has become the mandatory step for anyone wishing to apply for a Schengen visa. Until recently, applications had to be submitted directly to the relevant consulate. This service has gradually been outsourced to large private companies such as TLScontact, which generate millions of dinars and often resort to tax optimization strategies, at the expense of applicants.

Consular services at TLS

The French Consulate in Tunisia launched a call for tenders to outsource visa management operations in November 2011. By February 2, 2012, the private company TLScontact was selected to perform this task. Subsequently, TLScontact's primary task involved collecting visa applications and transferring them to the consulate. "TLScontact has been operating in Tunisia on behalf of France since 2012, Great Britain since 2014, Belgium since 2015 and Germany since 2022", detailed the TLScontact communications department, in response to inkyfada's queries.

"At the time, we recognized the pressing need for suitable facilities to efficiently process these visa requests. Our existing offices had become overcrowded, and we could clearly see the long waiting lines outside in the sun and cold. We therefore had to make the strategic decision to outsource the management of visa applications. After careful consideration, The choice fell on TLScontact," stated Martine Gambard-Trébucien, the former French Consul General, during a press conference. On February 17, 2012, the subsidiary TLScontact Tunisie was established.

Journalist Rachel Knaebel wondered, "how could a process so intrinsically tied to the State’s sovereignty be privatized?". Undoubtedly, the issuance of visas is a matter falling squarely within the State's sovereign prerogatives. For this reason, the visa application process has undergone a division of responsibilities: Consulates decide whether or not to grant visas, while service providers welcome applicants and forward their files. This model has gained global traction over the past 15 years, with TLScontact emerging as a prominent player. Operating an extensive network of 150 centers worldwide, TLScontact processes an impressive 4 million visa applications annually.

This entails significant benefits for government finances. A report by the French Court of Audit referred to outsourcing as "an economical solution for public finances", as its "cost (...) is borne by the applicant".

Today, when Tunisians apply for a visa, they typically spend hundreds of dinars: aside from visa fees, applicants must now pay TLScontact's inherent costs. In other words, TLScontact and its shareholders make a profit off of every visa application.

In 2019, for instance, the company's turnover exceeded the 20 million dinar mark.

This represents a profit of over 8 million dinars for the year 2019, after payment of taxes and operating costs. The Covid-19 crisis led to a substantial reduction in the company's revenues, but these have picked up once again since the borders were reopened.

Source: "National Business Register".

*Profits per year were calculated using the annual turnover minus expenses.

**inkyfada was unable to access data for the 2017 and 2018 balance sheets.

A fairly complex pattern

Based on the several administrative documents examined and analyzed by inkyfada, TLScontact Tunisie belongs to the multinational Teleperformance Group, based in France and listed on the Paris stock exchange - more commonly known as the CAC 40. Teleperformance advertises itself as "the global leader in outsourced customer and citizen experience management and related digital services".

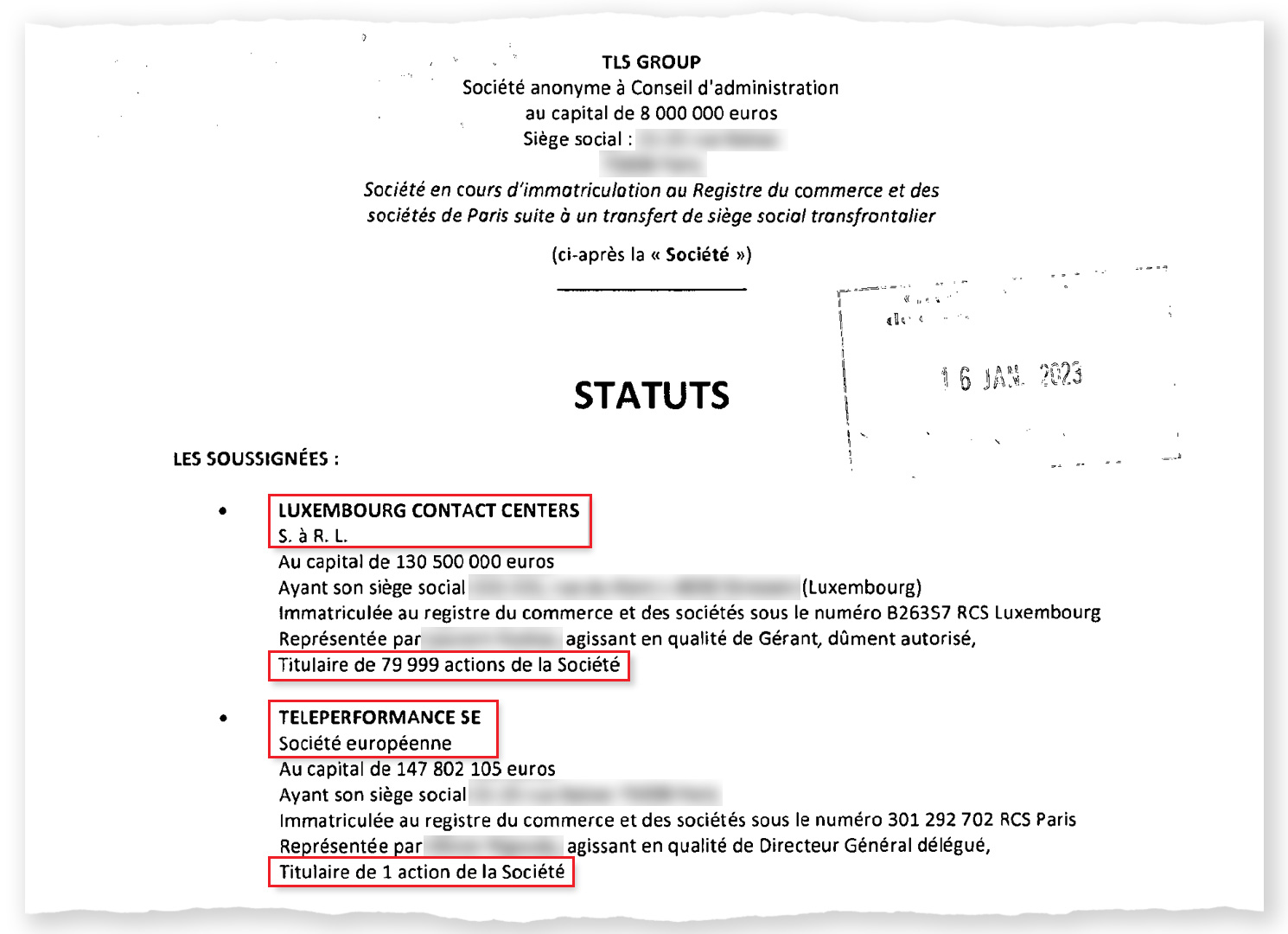

The pattern, however, is anything but linear. To get to Teleperformance, you have to go through a first intermediary, TLS GROUP S.A, which owns 99% of TLScontact Tunisie. TLS Group S.A. is in turn 99.99% owned by a second intermediary, Luxembourg Contact Centers. It was ultimately determined that the latter is 100% owned by the Teleperformance Group.

As such, all TLScontact Tunisie's profits are directed back to Teleperformance through these two Luxembourg intermediaries.

According to their respective balance sheets, TLScontact Tunisie transferred profits worth 1.957.177.48 euros to TLS Group S.A. in 2020, which is equivalent to almost 6.4 million dinars. During the same year, 80 million euros were transferred by Luxembourg Contact Centers to Teleperformance through all the subsidiaries owned by this intermediary.

The two Luxembourg-based intermediaries are investment management companies, owning the majority of the Teleperformance Group's subsidiaries across the world.

According to the minutes of an Extraordinary General Meeting held in November 2022, a decision was made to relocate the headquarters of TLS Group S.A. to France. This decision was based on the understanding that the necessary resources within the Group would primarily be located in France. The transfer of the premises is scheduled to take place in January 2023, along with the filing of the articles of association with the French Trade and Companies Register. Luxembourg Contact Centers, which still holds 99.99% of the shares, will, however, continue to operate in Luxembourg.

A typical tax optimization structure

Why does Teleperformance do business in Luxembourg? The Grand Duchy offers a number of advantages for this multinational: although not officially considered a tax haven*, this tiny European country has repeatedly been pointed out for its advantageous tax policy. Luxembourg is 6th in the Tax Justice Network's corporate tax havens ranking.

Examples of tax optimization strategies within a corporate group:

Tax consolidation: Offsetting losses and profits made by different group companies to reduce the group's tax burden.

Dividend repatriation exemption: In France, dividends are not subject to taxation between a parent company and its subsidiary.

Profit shifting to tax havens:

Transferring profits to subsidiaries located in countries with the most favorable tax regimes.

Luxembourg is particularly well known as a sought-after destination for profit shifting, given its advantageous tax system. "[Luxembourg] offers a wide range of tax optimization mechanisms (...). The effective tax rate is only 1% or 2%, thanks to these optimization possibilities. If it's not a paradise, it's at least a tax haven...", stated one of Le Monde's journalists, referring to the OpenLux investigation, in which inkyfada took part.

In 2021, for example, Luxembourg Contact Centers only paid a mere 574 633.12 euros in taxes on profits amounting to 64 764 103.23 euros. This translates into an effective tax rate of 0.89%.

While employing just two people each, the two Luxembourg-based intermediaries Luxembourg Contact Centers and TLS Group S.A. are making millions of euros in profits.

A large number of Luxembourg-based companies are used solely as conduits for financial flows. "These shell companies don't really conduct any business. They're only there to cut costs through tax optimization," commented Christoph Trautvtter of the German Tax Justice Network in an interview with Investigate Europe.

The OpenLux investigation revealed that "almost half of the commercial companies registered in the country are pure financial holding and offshore companies with assets totalling no less than 6.500 billion euros".

The profit shifting mechanism

The two Luxembourg-based intermediary companies mainly manage shareholdings and invoice services exclusively within the Group. These services may include software licensing fees, management services and interest on group receivables. This means that the services invoiced by the intermediaries are taxable in Luxembourg, rather than in the countries where the subsidiaries are based, where taxation is often less favorable than in the Grand Duchy.

"One of the best-known tax optimization mechanisms is profit shifting through the over-billing of certain services", explained a tax expert interviewed by inkyfada. These services are often overcharged when compared with market prices, or even fictitious. Deliberately unpaid receivables, for instance, can generate interest and then additional interest on this unpaid interest. "Besides, these bogus receivables remain unpaid for quite a long time, and are sometimes even abandoned despite the fact that the borrowing company has sufficient funds to repay them", the expert added.

TLSContact Tunisie's accounting records revealed that several services had been invoiced by the Luxembourg-based company TLS Group S.A. In 2021, the Tunisian company owed TLS Group S.A. 1.576.439 euros, at an interest rate of 5% per year, even though it had more than enough cash (3 million euros at the end of 2021) to repay this debt.

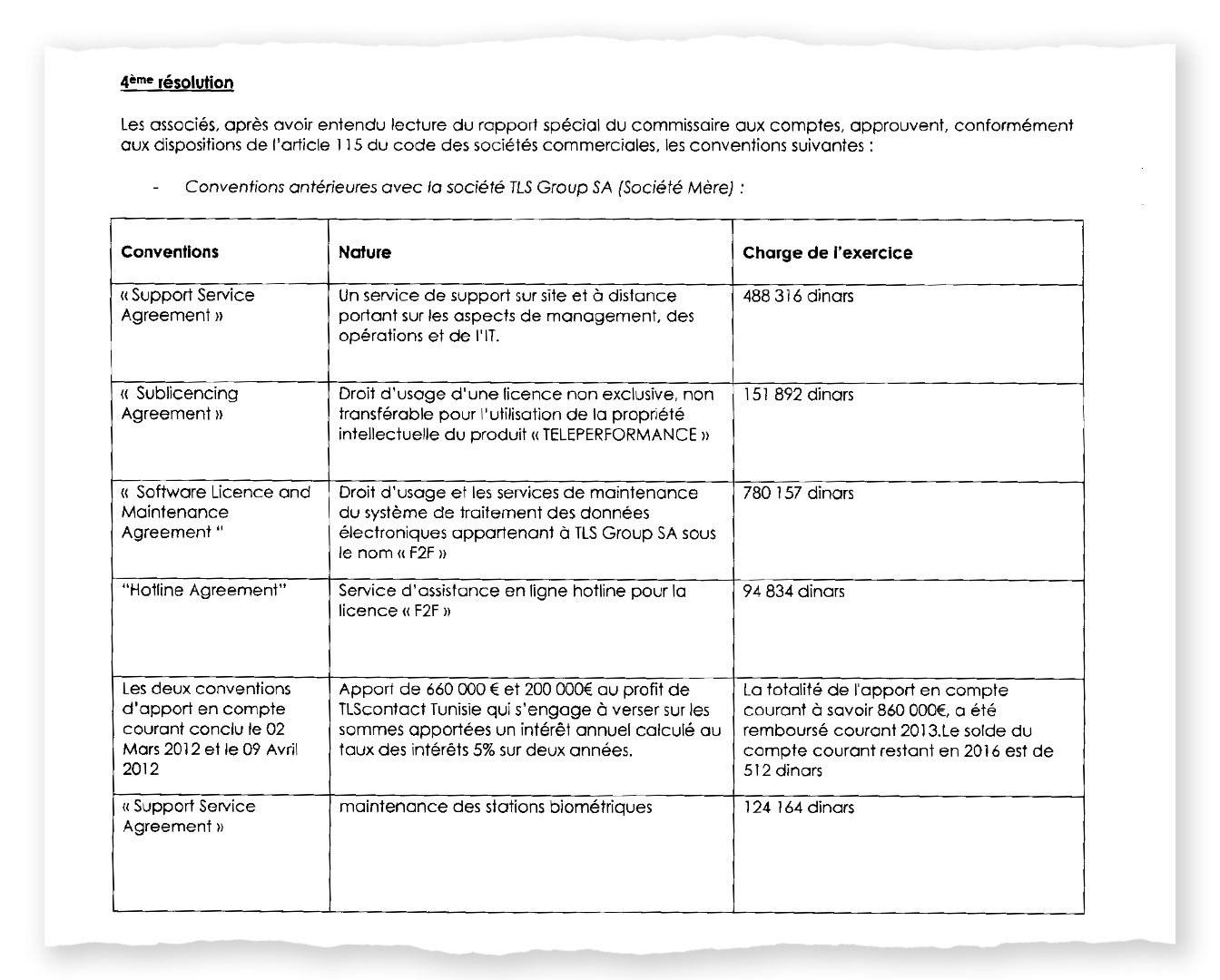

Apart from the interest on intra-group debts, other services are billed to the Tunisian company. The balance sheets indicate that the company incurs annual expenses related to contracts for "helpdesk", "telephone assistance," as well as "software licensing and maintenance services". In 2017, these expenses amounted to 1 639 363 dinars. The costliest service is associated with "the right to use and maintenance services of the electronic data processing system" for software owned by TLS Group S.A., billed at 780.157 dinars (or 260.000 euros).

Is this service over-billed? " We can't know for sure," said the expert. "But we can see that TLS Group has made a profit on the use of its software in just one year".

According to TLS Group S.A's financial statement for the year 2017, the software cost 4 096 644.44 euros. If only 20 of the Group's 40 subsidiaries paid the same amount billed to Tunisia for the use of this software, TLS Group S.A would not only recoup its investment within a year but also generate additional value. The documents also revealed that these same services are consistently billed on an annual basis. The expert confirmed, "this type of right-of-use contract typically lasts for about ten years".

This 4 million euro software was worth no more than 339 995 euros in 2017, since it was 92% amortized. "All these factors suggest over-invoicing," she summed up.

Teleperformance eyes the 10-billion milestone

Ultimately, all these schemes and tax advantages primarily benefit the Teleperformance group. The latter is by no means the only multinational to have a subsidiary in Luxembourg: more than half the groups in the CAC 40 are believed to do so, most often to carry out financial activities. Teleperformance, for instance, has four companies based in Luxembourg specifically dedicated to financial activities.

The report "State of Tax Justice 2022" by the NGO Tax Justice Network states: "Every year, multinational corporations shift over 1 trillion dollars from the countries where they genuinely do business – the countries where they sell goods and services, and employ staff – to tax havens where they pretend to do business, for example, by renting a mailbox or setting up a shell company that only exists on paper."

According to its financial statement for 2021, Teleperformance's specialized services, including TLS subsidiaries, accounted for 12% of the total turnover. "TLScontact's turnover has increased almost 50-fold in 10 years... In the long term, beyond the ongoing impact of the health crisis on TLScontact's activity in 2022, the company's growth prospects are highly favorable."

The Teleperformance Group is aiming for "a turnover of over 10 billion euros" by 2025.

Several Consulates using the services of TLS Contact Tunisie have been contacted by inkyfada. When asked about its association with the company, which allegedly engages in tax optimization strategies, the German Consulate simply stated that "TLS has proven to be a reliable partner in [their] cooperation in Tunisia", and that the German Ministry's “exclusive contractual partner was TLScontact". The Belgian Consulate's response wasn't much different, stating that "the TLS subcontracting company with which Belgium has a contractual relationship is based in Paris, France" and that it had "no comment to make on its parent company, Teleperformance". France declined to respond to inkyfada's questions.