"The IMF's diktats, which lead to further impoverishment, are unacceptable", declared President Kais Saied to the press on Thursday April 6, while visiting Monastir to commemorate the 23rd death anniversary of former President Habib Bourguiba.

The President immediately added that "the alternative is to rely on ourselves". In other words, Kais Saied has put long months of negotiations between the IMF and Tunisia on hold for the time being, despite the current economic and financial crisis affecting the country, characterized by chronic budget and trade deficits, as well as the ongoing devaluation of its currency.

Over the past few months, the pressure on Tunisia has been mounting. From the European Union to the United States, all parties involved in these negotiations have been trying to convince President Kais Saied that a loan from the Fund would enable Tunisia to recover. The EU's chief diplomat, Josep Borrell, believes that Tunisia is " at risk of imminent collapse", a statement deemed "disproportionate" by the Tunisian Foreign Minister.

The EU's determination to reach an agreement does not conceal its greatest fear: a "migratory crisis" if the country remains economically unstable. One of the most virulent is Giorgia Meloni's Italy, which is constantly pressing the Fund to reach an accord.

On the same subject

Tension underlies crucial negotiations

Negotiations are proving problematic in Tunisia, given the IMF's recommendations. Kais Saied finds the gradual reduction of the subsidy system, which controls the prices of basic products, particularly unpalatable.

To support this position, the President made reference to the "bread riots" that broke out in January 1984, when the Tunisian authorities lifted the subsidy on cereal products, sparking a sharp rise in bread, semolina and pasta prices.

The privatization of certain companies, also recommended by the IMF, could well trigger social tensions. The IMF Managing Director's statement on the possibility of discussing privatization has prompted a strong reaction from public-sector trade unions.

Up until now, the Tunisian General Labor Union (UGTT), the country's main trade union body, has been strongly opposed to the privatization of public companies, but has recently moderated its position. It's now suggesting a case-by-case approach to restructuring.

Several years ago, for instance, the UGTT approved the termination of some 1 000 out of a total workforce of 6 500 employees at Tunisair, the public airline. Besides, the restructuring plan presented by Tunisair's current management is consistent with the IMF's reform program recommendations. This includes the sale of non-core assets such as old aircraft and company-owned real estate, as well as a strategic partnership.

While all these measures - backed by the IMF - have been incorporated into the 2023 Finance Law, they have yet to be implemented. President Saied is unwilling to put them into effect so as to preserve social peace, which he insists "is not a game and cannot be taken lightly."

Social and fiscal equity researcher Amine Bouzaiene told Inkyfada that, despite his rhetoric, Kais Saied hasn't necessarily ruled out the IMF altogether. "He might be deliberately trying to improve the terms of the agreement, but it's not certain that the President is categorically against all agreements with the IMF. At this point, when you're a leader, you have to at least try to cut your losses through negotiation”.

"If he agrees to this deal, the President will be compelled to implement the reforms, which could lead to problems in the short term. I personally think it'd be tantamount to suicide. When the President of the Republic talks about social peace, it's the least he can do", adds the researcher.

Tunisia, the IMF, and the endless tale of reform

President Saied is firmly convinced that these reforms are nothing but dictates, which explains his unshakeable stance and his subsequent decision to halt the negotiations. Tunisia has a history of defying IMF reform prescriptions when seeking financial assistance, and this case is no exception.

From 1993 to 2013, Tunisia has refrained from turning to the IMF. After the country's economic conditions started deteriorating in 2013, however, Tunisia applied for a loan while proposing a reform program. "Contrary to popular belief, there are no diktats; each country has to come up with a reform program. The IMF's objective is to ensure that the country can manage to pull through," explained Tunisian economist Ezzeddine Saidane, in an interview with inkyfada.

But despite its promises, Tunisia has never implemented the proposed plan. Three years later, it once again promised to implement the reforms. However, it failed to deliver on this commitment yet again, resulting in sanctions from the IMF, which canceled the payment of a 1.2 billion USD tranche.

The combination of this liability and Kais Saied's recent speeches has “severely damaged Tunisia's credibility in the eyes of the IMF from the outset," remarked Ezzeddine Saidane. He further asserted, "The IMF expressed immediate concern regarding Tunisia's capacity to successfully implement the required reforms," adding that “today, President Saied's actions have only served to validate the IMF's doubts about Tunisia's preparedness to undertake these reforms.”

Kais Saied's stance serves to underline and exacerbate the differences between the presidency and the government. "The reform plan which was rejected by Saied is a 100% Tunisian plan, put forward by the Tunisian government itself," affirmed Ezzeddine Saidane.

According to him, this lack of trust played a pivotal role in the IMF's decision to reject Tunisia's application. "The divisions between the President and the government prompted the IMF to turn down Tunisia's request on December 17," he stated. A tense standoff has persisted between the Fund and Tunis ever since. The situation took a turn for the worse with Kais Saied's speech on April 6, which seemingly halted negotiations and left the next phase in limbo.

When contacted by Inkyfada regarding the matter of reforms, Marc Gérard, the IMF representative in Tunisia, refrained from providing any comment or reply.

A need to break free from the IMF’s grip overseas

Some countries have voiced their willingness to distance themselves from the International Monetary Fund over the past few decades - whether on a case by case or on a longer-term basis - casting doubt on its role and impact on their economies.

Hugo Chávez’s Venezuela has pursued a policy of rejection towards the IMF and opted for socialism as an autonomous economic path. But ineffective economic policies, corruption and over-reliance on oil revenues have led to a severe economic crisis and hyperinflation. As a result, the country is currently grappling with severe economic and humanitarian challenges.

During the 2000s, Ecuador expressed its intention to sever ties with the IMF and terminated its aid program with the institution. Nevertheless, due to ongoing economic challenges, the country eventually decided to re-engage with the IMF in 2009, as a means of obtaining financial support. Ever since, Ecuador has maintained a volatile rapport with the IMF, seeking cooperation while at the same time preserving a certain level of autonomy in its economic policies.

Both of these examples demonstrate that the rejection of the IMF has, at first glance, had detrimental consequences. However, the situation in Argentina took a different turn. In 2000, with its economy in dire straits, Argentina sought help from the IMF. An agreement was reached between the two parties, and the country was granted a multi-billion dollar loan. As a condition for this financial aid, Argentina committed to implement a series of economic measures recommended by the IMF.

Though Argentina initially complied with the agreed reform program, the country's economic situation took a turn for the worse, culminating in a deep crisis. Austerity policies, debt crisis, peso devaluation... This disastrous experience prompted questions about IMF policies and sparked debate about the effectiveness of measures imposed by international financial institutions on developing countries. Argentina has since undertaken internal economic reforms in a bid to consolidate its economic autonomy and avoid relapsing into a similar crisis. By diverging from the IMF's recommendations, the country was in fact able to achieve a notable recovery.

Although the Fund may provide a temporary solution, complying with these loan conditions can sometimes further exacerbate poverty and debt. One of the reasons behind this outcome is the IMF's tendency to promote uniform economic recommendations and general structural adjustment plans, often without considering local contexts and specific circumstances. Amine Bouzaiene's observations affirm that Tunisia is not exempt from this pattern.

"The program that has been drawn up is perfectly consistent with the IMF's recipe. So while it may not have been imposed, the Tunisian government was faced with the crucial task of aligning itself as closely as possible with the IMF's recommendations. This approach is not specific to Tunisia, it's what the IMF has been doing everywhere."

Aram Belhadj, PhD in economics believes, however, that reaching an agreement with the IMF is imperative considering Tunisia's economic circumstances: "Even the Minister of the Economy insists that there is no alternative plan, and I think he knows what he's talking about, considering the magnitude of the financial needs," he worried. "Tunisia needs a staggering 15 billion dinars for the financial year 2023 alone. Without an accord with the IMF, mobilizing such significant resources would be an insurmountable challenge. Securing a deal with the IMF is an absolute necessity."

Offering a contrasting perspective, Amine Bouzaiene, underscored the importance of evaluating the IMF's historical performance and drawing pertinent conclusions. "We decided to adhere to the international monetary institutions' recommendations in the past, and look where that got us. (...) So, at some point, we need to get out of this theoretical and academic framework and assess the IMF's track record," he maintained.

The BRICS' lure

"It's not unlikely that the President is pursuing other possibilities, which would require Tunisia to change course," remarked Amine Bouzaiene. "Although we've always relied on the West, we could now explore other horizons and secure financing."

Given the recent robust economic growth experienced by the BRICS nations (Brazil, Russia, India, China, and South Africa), there is growing speculation about whether they could serve as viable alternatives for Tunisia in addressing its economic challenges.

While Tunisia relies heavily on the European Union as a primary trading partner, forging closer cooperation with the BRICS could potentially enable it to diversify its trade landscape and reduce dependence on a single market. By fostering stronger economic ties with these countries, Tunisia could unlock new avenues for its products and services, thereby resulting in an upsurge in exports.

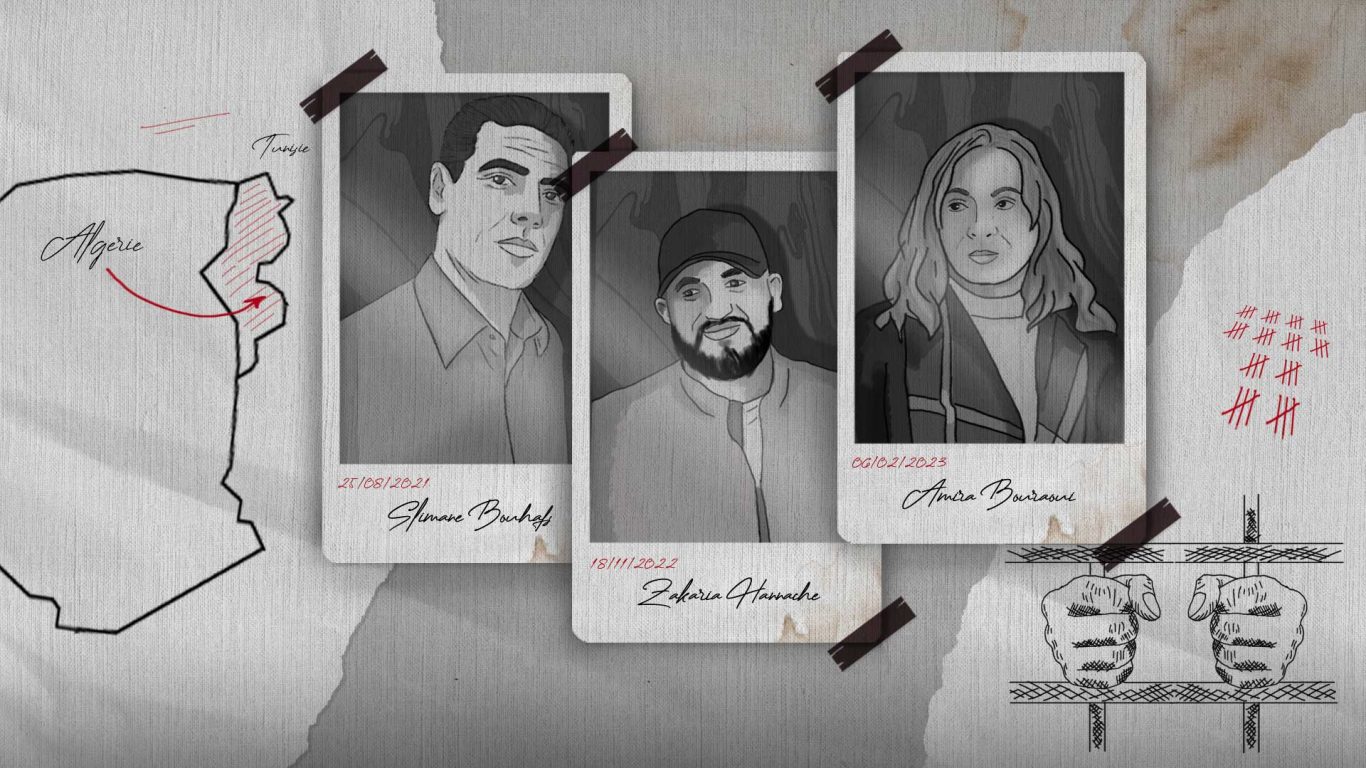

Whether this will mean official membership or "mere" economic assistance remains unclear, however. Unlike Algeria, which has officially applied to join the BRICS, Aram Belhadj believes that Tunisia does not have the same weight to qualify for membership of the group.

"Although Algeria has officially made the request to join, it possesses resources that Tunisia currently lacks," explained Aram Belhadj. "Tunisia's deep attachment to Europe also limits its influence and prevents it from having the necessary leverage to become a member of the BRICS, which is comprised of economic behemoths." he added.

For his part, Ezzeddine Saidane considers the prospect of the BRICS to be nothing but an illusory solution. "70% of our exports* are directed towards European markets, and Europe is a vital source for Tunisia's tourism industry, and we're supposed to turn our backs on that?" the economist wondered. "If Tunisia deems it unsafe to pursue such reforms, it should explore alternative avenues for financing without severing ties with the European Union."

Amine Bouzaiene contends that considering the BRICS does not imply forsaking the European Union. "At this stage, such a notion is an oversimplification and it may be a form of European intimidation. The EU has the capacity to accommodate Tunisia's unique circumstances where certain reforms may not be applicable, while still maintaining mutually beneficial trade relations. It is the very essence of free trade".

In contrast, the BRICS nations present distinct economic policies and development models. China holds a prominent position and even has "outsider" status vis-à-vis the IMF, having become the second-largest lender after the Fund.

China's approach to international loans granted to developing countries has evolved over time. Initially, China's loan strategy contributed to their growing debt burdens. This was achieved through the provision of substantial loans for infrastructure projects like bridges, roads, railroads, and ports, which were crucial for the countries' progress. However, these loans were often disbursed swiftly and involved substantial amounts of money.

Over the past decade, the nature of these international loans has undergone a remarkable transformation. Currently, a substantial 60% of Chinese loans are allocated to bail out countries grappling with financial distress, marking a considerable increase compared to the mere 5% observed 12 years ago.

Unlike agreements with international financial institutions such as the IMF or the World Bank, Chinese loans are often characterized by less stringent conditions. This may seem attractive to countries facing financial difficulties, prompting them to borrow more, which in turn generates more debt and limits the governments' ability to implement autonomous economic policies.

Despite the evolution of Tunisia's eastern policy and Xi Jinping's invitation to Kais Saied, the Chinese Ambassador in Tunis recently asserted that it "would be quite a challenge for Tunisia to find an alternative to the IMF", adding that recourse to this institution was "indispensable". He also acknowledged President Kais Saied's viewpoint that Tunisia needed to rely on itself.

On the same subject

Recovering embezzled money: a populist promise

Kais Saied offers a resolute response when it comes to exploring alternatives: "We must rely on ourselves." With compelling rationale, this notion resonates within Carthage and echoes through presidential speeches: the funds required to pay off debts are not in the IMF’s pockets; they’re rather scattered across the globe. "Why won’t the foreigners give us back the money that was unjustly taken from us? Return what is rightfully ours – the Tunisian people's hard-earned wealth," he passionately proclaimed.

During Zine El Abidine Ben Ali's authoritarian rule from 1987 to 2011, the Ben Ali/Trabelsi clan faced allegations of embezzling substantial amounts of public funds. Following the revolution, the confiscation commission valued their assets at approximately 13 billion dinars, the equivalent of around 4 billion euros.

These funds were allegedly transferred to foreign accounts in Switzerland, France, and Canada. Additionally, a considerable number of assets, such as real estate, yachts, and luxury cars, were acquired. Since assuming office, President Kais Saied has consistently expressed his unwavering commitment to retrieving these misappropriated funds. He reiterated this stance on Thursday, April 6, after vehemently criticizing the IMF and rejecting its aid.

On the same subject

Although this measure may appear appealing in theory, it could be perceived as a populist declaration due to the impracticality of its execution. Experts argue that the reliance on the 13.5 billion dinars mentioned by Kais Saied is unrealistic and even unfounded, particularly considering that these figures are derived from reports drafted in 2011, a dozen years ago. As a result, the feasibility of such an endeavor may be illusory.

This sum of 13.5 billion dinars includes bank loans, companies, and illicitly acquired wealth. However, there are several complications as some of the bank loans have since been repaid, certain companies have been sold or have lost their value over time. As for the ill-gotten gains, several individuals have successfully demonstrated their legitimate origins.

Is Algeria behind an Arab coalition to help Tunisia?

Aid to Tunisia could very well come from neighboring Algeria and several Gulf countries. The Algerian daily El Watan's report suggested that financial aid of up to "3 or 4 billion dollars is not entirely excluded ", while Algeria has openly criticized what it perceives as "blackmail" by international financial institutions towards Tunisia. Algeria's Ambassador in Rome, Abdelkarim Touahria, asserted that his country is working closely with Italy "in an effort to preserve Tunisia's stability ”.

Over the past three years, relations between the two countries have grown considerably stronger. Algerian Communication Minister Mohamed Bouslimani declared, "Algeria has chosen to wholeheartedly support Tunisia". This rapprochement is seen by Amine Bouzaiene as a viable solution. "You have to be able to engage with all potential partners, including Algeria. Of course, the Gulf countries possess substantial resources, they can potentially replace the IMF. Tunisia's needs are nothing compared to their budgets, so I think we could opt for that."

On the same subject

There is still a major concern, however, regarding the Presidency's plans. Kais Saied, who must strike a balance between economic independence and the need for international support to meet the economic challenges facing the country, has yet to propose any alternatives to the IMF after having rejected their assistance.